Our Programs

Work Load Financing

Work Load Financing doesn’t require a minimum credit score or minimum time in business. Funding is based upon the work load and revenue that the equipment will generate for the business.

Work Load Financing doesn’t require a minimum credit score or minimum time in business. Funding is based upon the work load and revenue that the equipment will generate for the business.

Generally, we’ll quickly finance equipment that generates a consistent and profitable monthly cash flow, with only an application and 3 months company bank statements.

Project, Plant and Equipment Financing

Specialty project plant and equipment financing enables companies to plan their ongoing capex throughout the year. This program offers turnkey solution choices, not only can it fund your equipment purchase, it also provides the option of funding a wide range of soft costs such as, manufacturer deposits, progress payments, site preparation, installation, staff training, start-up commissioning, etc.

Specialty project plant and equipment financing enables companies to plan their ongoing capex throughout the year. This program offers turnkey solution choices, not only can it fund your equipment purchase, it also provides the option of funding a wide range of soft costs such as, manufacturer deposits, progress payments, site preparation, installation, staff training, start-up commissioning, etc.

Generally we look for companies with current annual revenues of at least $6.million, although we will consider companies with lower revenue that can demonstrate upwards growth that will be generated by the plant and equipment we underwrite.

Venture & Expansion Stage Capital Credit Line

Privately managed venture capital funds provide nimble and flexible Venture & Expansion Stage lease lines of credit starting at $500,000 for growth and expansion stage companies.

Privately managed venture capital funds provide nimble and flexible Venture & Expansion Stage lease lines of credit starting at $500,000 for growth and expansion stage companies.

We provide venture capital for companies that may have challenges gaining access to significant expansion capital, including those in start-up, pre revenue, pre or post IPO stage, have previous loss history or current negative cash flow, are maxed out on credit exposure, or whose credit is deemed too risky.

Determining factors are for the assets to generate a strong cash flow and ROI. Typically we do not ask for warrants or require blanket liens and we don’t get hung up on valuation history or equity capital structure.

Although we prefer investing in companies and partnerships, we will consider solid sole proprietorships. Funding for tangible assets, including IT hardware, plant and machinery, production equipment and items located at third party locations.

Favored equipment includes

- Equipment utilizing current and cutting-edge technology for industrial and commercial applications over a broad range of industries.

- Rental plant and equipment

One page Application Only Programs

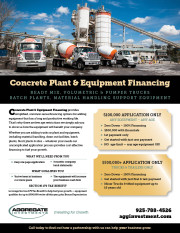

Concrete Plant & Equipment #1

Concrete Plant & Equipment Financing provides simplified, common sense financing options for adding equipment that has a long and productive working life. That’s why there are few age restrictions we simply ask you to show us how the equipment will benefit your company.

Concrete Plant & Equipment Financing provides simplified, common sense financing options for adding equipment that has a long and productive working life. That’s why there are few age restrictions we simply ask you to show us how the equipment will benefit your company.

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

Concrete Plant & Equipment #2

Concrete Plant & Equipment Financing provides simplified, common sense financing options for adding equipment that has a long and productive working life. That’s why there are few age restrictions we simply ask you to show us how the equipment will benefit your company.

Concrete Plant & Equipment Financing provides simplified, common sense financing options for adding equipment that has a long and productive working life. That’s why there are few age restrictions we simply ask you to show us how the equipment will benefit your company.

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

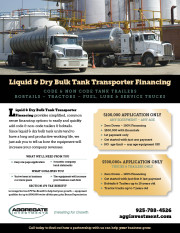

Liquid & Dry Bulk Tank Transporter

Code & Non Code Tank Trailers – Bobtails – Tractors – Fuel, Lube & Service Trucks

Liquid & Dry Bulk Tank Transporter Financing provides simplified, common sense financing options to easily and quickly add code & non-code trailers & bobtails. Since liquid & dry bulk tank units tend to have a long and productive working life, we just ask you to tell us how the equipment will increase your company revenues.

Liquid & Dry Bulk Tank Transporter Financing provides simplified, common sense financing options to easily and quickly add code & non-code trailers & bobtails. Since liquid & dry bulk tank units tend to have a long and productive working life, we just ask you to tell us how the equipment will increase your company revenues.

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

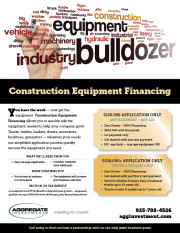

Construction Equipment

You have the work — now get the equipment. Construction Equipment Financing allows you to quickly add the equipment needed to help your company grow. Trucks, trailers, loaders, dozers, excavators, backhoes, generators — whatever your needs our simplified application process quickly secures the equipment you need.

You have the work — now get the equipment. Construction Equipment Financing allows you to quickly add the equipment needed to help your company grow. Trucks, trailers, loaders, dozers, excavators, backhoes, generators — whatever your needs our simplified application process quickly secures the equipment you need.

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

Commercial Programs

Turnkey Plant & Equipment Financing

to $20+ million

With a $250,000 initial draw down threshold and $20million+ maximum, Turnkey P&E Financing provides an all-inclusive turnkey option for growing middle market companies to add capital equipment.

With a $250,000 initial draw down threshold and $20million+ maximum, Turnkey P&E Financing provides an all-inclusive turnkey option for growing middle market companies to add capital equipment.

In addition to financing the equipment, customers may include as many soft cost options as required, including deposits & pre-payments, site preparation, installation, support equipment,

software staff training, etc.

Click on this image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

Venture & Expansion Stage Capital Credit Line

Privately managed venture capital funds provide nimble and flexible Venture & Expansion Stage Plant & Equipment Credit Lines, ranging from $1 million to $15 million for companies in growth or expansion stages. From start-up or pre-revenue to publicly traded, we are able to support a company’s equipment venture leasing needs from infancy to maturity.

Privately managed venture capital funds provide nimble and flexible Venture & Expansion Stage Plant & Equipment Credit Lines, ranging from $1 million to $15 million for companies in growth or expansion stages. From start-up or pre-revenue to publicly traded, we are able to support a company’s equipment venture leasing needs from infancy to maturity.

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.

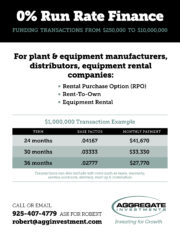

0% Run Rate Finance

For plant & equipment manufacturers, distributors, equipment rental

For plant & equipment manufacturers, distributors, equipment rental

companies:

- Rental Purchase Option (RPO)

- Rent-To-Own

- Equipment Rental

Click on image to enlarge, or download a pdf here. For more information, or to apply for this program, simply complete this form and email it back to us.